3 Facts About Commercial Fire Insurance Coverage

1/11/2021 (Permalink)

Commercial Fire Insurance

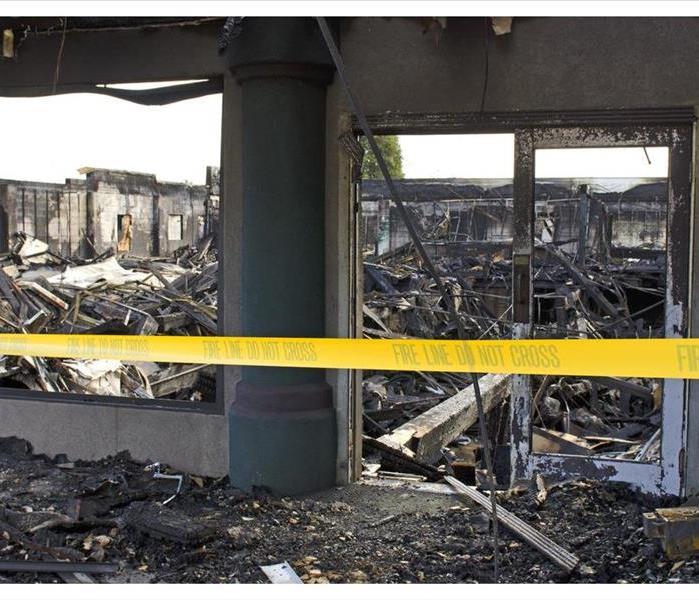

The owner of a building should be familiar with the terms and limits of fire insurance coverage under a general commercial property policy. A basic awareness of exclusions and limits can help the named insured take appropriate fire safety and prevention measures and be prepared to make a claim for fire damage at a building in New Hope, PA.

1. Commercial General Property Insurance Policies Cover Most Fire Damage

Most fires that occur at business locations or in commercial buildings are covered by a property insurance policy. This policy should cover, or at least offset, the costs of mitigating and cleaning damage and completing commercial fire restoration. Even smoke cleanup should be covered. The major exceptions to this fact include intentional fires and incidents that occur at vacant properties.

2. Property Owners Should Support Claims With Documentation

Submitting documentation to an insurer in the form of photographs or video footage can be helpful when making a commercial fire insurance claim. While an adjuster will still need to visit the location, this evidence may facilitate the early stages of processing a claim.

3. Additional Interruption Insurance Can Offset Ongoing Expenses

Most property insurance policies do not include coverage for business interruptions. In the case of moderate to major fire damage, a business may not be able to operate for days, weeks, or months. Some operations can temporarily relocate to another location. If this is not an option, a business interruption insurance policy can help to cover the costs of covering payroll, a lease or mortgage, or utility bills.

The holder of a commercial property insurance policy should review the terms of fire insurance coverage. It can be helpful to go over a policy with an insurance agent or representative to ensure that limits are high enough to cover restoration costs for partial losses or the total loss of a structure in New Hope, PA.

24/7 Emergency Service

24/7 Emergency Service